Postconsumerism. It’s about more than whether you do or don’t buy “stuff”, but one of the first ways to let go of a cultural addiction to the consumer machine is to understand what’s enough and buy enough rather than too much (and for the wrong reasons). Of course, that’s easier said than done. The first challenge is learning to find your own line of what’s enough. Hopefully, much of the information on Postconsumers.com will help you do that. The second challenge is enacting the art of buying less – and living more. Ultimately, of course, it comes down to will power. But to help get you there, we’ve put together twenty of our favorite fast tips for buying less. Ready, set…refrain!

1. Say No to Plastic! For most of us, part of the reason that we buy too much is that we buy more than we can afford. Leave the plastic at home and shop with cash only. You’ll quickly notice that you’re buying less – and accruing less debt.

2. Learn to Love Post It® Notes: Sometimes a friendly reminder is all that you need. If you really do need to carry your credit cards, be sure to put a Post It note on top of them to remind yourself not to over-spend or buy unnecessary things.

3. Don’t Jump On the Coupon Band Wagon: Coupons definitely have their place in the Postconsumer’s life and they can help you to save money for valuable things – like vacations! But coupons are designed to do one thing and one thing only – incentivize you to shop! Don’t buy things just because they are on sale and cheap with a coupon. Instead, look for coupons for items you really need and save on those.

4. Don’t Jump On the Loyalty Points Band Wagon: Much like coupons, loyalty points can save you big money when they’re used well. But also just like coupons, they’re ultimately designed to convince you to shop more. Just remember, anything you’re getting because you stacked up loyalty points may not be worth the money you spent to get there.

5. Don’t Jump on the Bulk Shopping Band Wagon: Do you sense a theme here?! Especially when it comes to food, bulk shopping is rarely the answer. The net price you’re paying is probably less, but the amount of food and “stuff” that you’ll end up wasting is also almost always more. You don’t come out ahead in that game, and you end up with more than you need.

6. Avoid Big Box Stores and Discount Stores: There are many, many reasons to avoid big box and discount stores if you want to wean yourself off of society’s addictive consumerism. You’ll be in a consumer-friendly environment, the stores are designed to entice you to buy, buy, buy and the prices are so low you may not realize how much you’re buying. Opt for smaller stores, or stay laser targeted.

7. Buy for the Long Term: Remember, quality is always better than quantity. Instead of buying the cheapest version of something and then buying ten other things that you don’t need, save up cash to buy the premium version of something and forego the other stuff. You’ll enjoy more luxury and also find that your “stuff” lasts longer.

8. Smart Phones Can Be Good! The media overkill of consumerism is one of the things working against your effort to buy less, but your smart phone can actually be a tool for good! How? Install a budget app on your phone so that you’re accountable to yourself at every moment for what you do and don’t spend.

9. Learn Need vs. Want: Learning to distinguish between what you need and what you want is one of the most important parts of learning to embrace buying less “stuff.” It’s often a good idea to start with the harder part – buying only what you need and then finding a happy middle ground between need and want as you get used to saying no to things just because you want them.

10. Have a Budget: Of course, to stick to a budget, you have to have a budget! If you’ve never set a budget for yourself before, it can be daunting and even a little bit depressing. But you need to understand what your actual, physical financial limits are before you can make good decisions about how to change them.

11. Never Use One-Click Shopping: If you can purchase something in one click, just say no! One click shopping makes it too easy to make impulse purchases of things that you don’t really need. Even if the (more convenient) one click shopping is an option, opt instead to fill out all of the forms and give yourself the time that you need to really think about your purchase.

12. Use a Shopping List: If you already know what you want before you go into the store and you stay focused, you’re far less likely to end up buying something that you don’t really need (or even want!). Always, always, make a shopping list before you go into any store. Then only get the items on that list … no matter what!

13. Have a Hard Count Item Cut Off: An alternative to a shopping list can be to give yourself a hard count cut off on how many items of a particular type you buy in one month (or even week). For example, if you have a consumer problem with buying too many shoes, give yourself a limit of no more than two new pairs per month. Wherever your natural line is, push it back until eventually, it’s entirely minimized.

14. Don’t Be an Emotional Shopper: Shopping definitely fills an emotional need for some people in the same way that eating does. The phrase “retail therapy” exists for a reason. Much like you should never grocery shop when you’re hungry, you shouldn’t shop for “stuff” when you’re depressed or blue.

15. Mentally Prepare for the Checkout Lane: The checkout lane at any store is a consumer addict’s worst nightmare. It’s like being at an open bar party as an alcoholic. The checkout lane is an area of the store where you are trapped with nothing to distract you, and store designers know that. They’ve run dozens and dozens of tests to figure out what to put there to get you to buy that one extra thing. Stay strong! Remind yourself that there is nothing, NOTHING, in the checkout aisle that you need to buy!

16. Make It a Team Event: We’re all stronger in numbers! Like any change that you’re trying to make in your life, if you have a partner in crime you’re more likely to be successful. Make it a family event or challenge or team up with a friend or co-worker to make the change today.

17. Go On a Media Diet: You are born with a biological urge for “more” (that you can tame) but you aren’t born with consumerism hard-wired in your brain (no matter what others may tell you). You’re receiving messages about the need to “be what you own” from somewhere, and that somewhere is the media. TV, radio, the internet and even your mobile phone are all sending you consumer directives both obviously and subliminally every day, all day. How do you defeat them? By ignoring them. Give yourself some media free time every day to unwire from the machine.

18. Reward Yourself: It may seem counter intuitive to reward yourself for buying less stuff, but it’s not. You don’t want weaning yourself off the consumer machine to feel like a punishment when in fact it’s a reward that will give you a more fulfilling life. So when you set goals about buying less stuff and then achieve them, give yourself a reward. What’s a great reward? That’s up to you! It could be a massage, a trip, a good dinner or, yes, even a “thing” that you’ve wanted!

19. Think Strategically About the Holidays: Consumer season starts in the fall and lasts through Valentine’s Day. Of course, you’re supposed to be buying things all year long, but even the marketing powers that be understand that people are more active in the summer and therefore buy less. As consumer season ramps up with back to school and the massive holiday shopping season, resolve to be even stronger about knowing the difference between what you should and shouldn’t be spending money on.

20. Unsubscribe from Deals Sites and Newsletters: Do you really need a new flatiron? Or this month’s sale items? Do you? You probably don’t, but that doesn’t mean that you won’t be tempted into the impulse buy when your daily deals email lands in your inbox. Yes, by unsubscribing from these services you may miss some unbelievable deals on things that you really do need. But the more important outcome will be that you don’t find yourself making unnecessary impulse buys.

Have a way that we missed to learn to buy less? Tell us about it on Facebook, Twitter, Pinterest or Instagram.

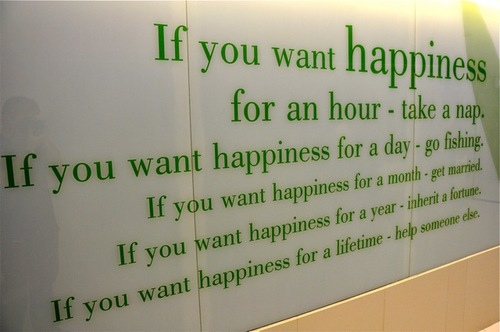

Photo Credit: Erno Hannink via Flickr